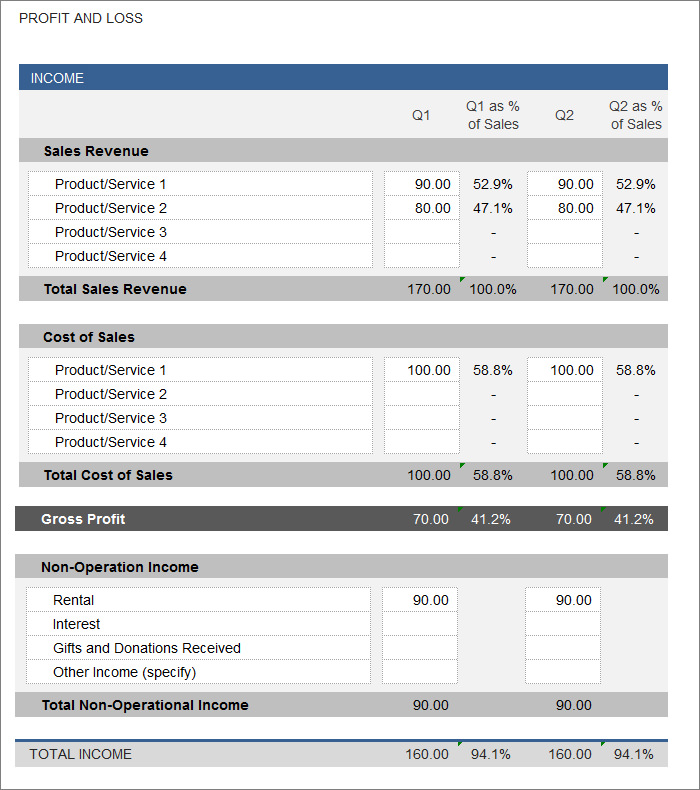

Regardless of the type of business, the first step is to determine the period of time to be evaluated - usually for a quarter but can be a month, a year, or even a week.

For new businesses, a profit and loss statement will give you a good idea of how things are going.

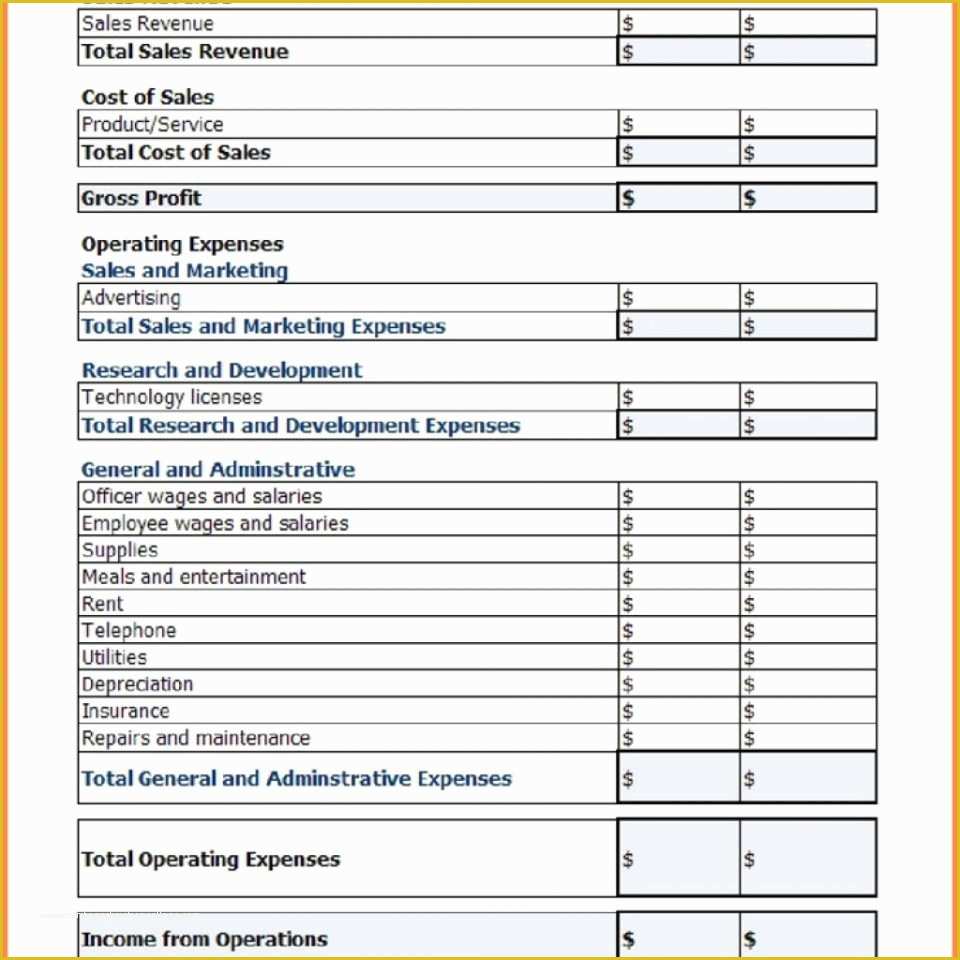

Whether a business sells goods or provides services, a P&L statement can help determine how it has been performing in the past and predict how it may perform in the future. Use a P&L template to calculate your net income (gross income minus expenses), and whether you need to increase income or reduce costs. No-code required.īusinesses use profit and loss (P&L) templates to list revenue and expenses to determine profitability.

Intelligent workflows Automate business processes across systems.Governance & administration Configure and manage global controls and settings.Streamlined business apps Build easy-to-navigate business apps in minutes.Integrations Work smarter and more efficiently by sharing information across platforms.Secure request management Streamline requests, process ticketing, and more.Process management at scale Deliver consistent projects and processes at scale.Content management Organize, manage, and review content production.Workflow automation Quickly automate repetitive tasks and processes.Team collaboration Connect everyone on one collaborative platform.Smartsheet platform Learn how the Smartsheet platform for dynamic work offers a robust set of capabilities to empower everyone to manage projects, automate workflows, and rapidly build solutions at scale.

0 kommentar(er)

0 kommentar(er)